Mohegan Gaming completes refinancing following loss to South Korea

Mohegan Gaming completes refinancing following loss to South Korea

The American operator has finished a "significant" financing plan to put off debt repayments until 2029 in the wake of its problems in South Korea.

Last Thursday, a press release was issued by the Mohegan Tribal Gaming Authority and its subsidiary, MS Digital Entertainment Holdings. The announcement detailed several financial transactions, including a $1.2 billion refinancing, the agreement to extend a portion of the 2027 unsecured notes to 2029, the exchange of $226 million of unsecured notes for 2031 secured notes, and the establishment of a $250 million revolving credit facility.

In a separate transaction, the Mohegan tribe extended the maturity of $100 million in unsecured notes issued in 2027 to 2032.

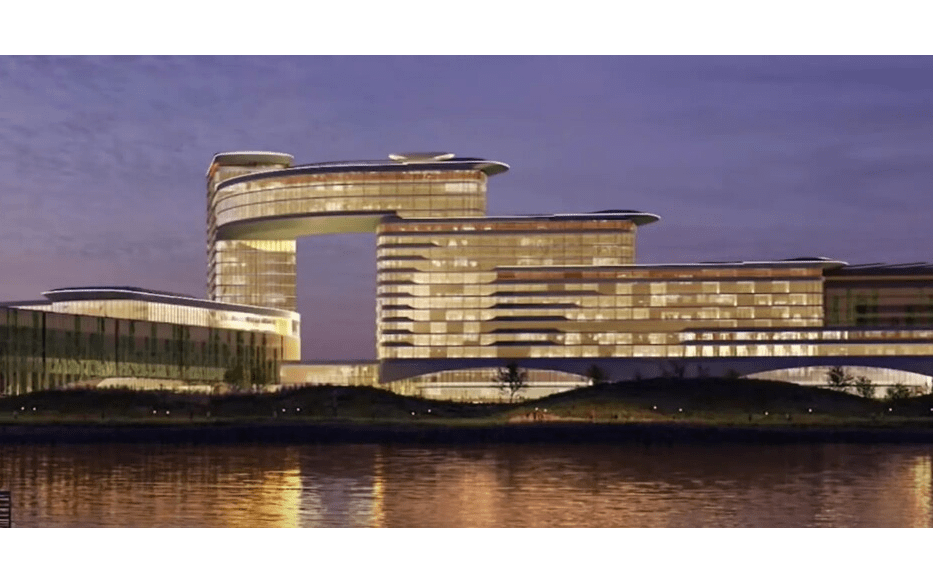

Roughly sixty days after Mohegan lost control of Inspire South Korea due to a finance issue, the package came together. Opening in March 2024, the integrated resort (IR) close to Incheon International Airport was Mohegan's first foray into the cutthroat Asian gaming industry.

At its grand opening, the IR featured three towering hotels, a concert hall with seating for 15,000, extensive conference facilities, an indoor water park, and a casino that was only accessible to foreigners. The tribe was on the verge of collapse when Inspire was named "the Las Vegas of South Korea" in an instant.

Leadership transition in South Korea

Although they lost $235 million in fiscal year 2024, Mohegan reported record revenues of $1.9 billion. Recognising "an imminent debt covenant violation" that threatened its ability to continue operations, it made the admission in January. It said that ramp-up expenses in South Korea and low table hold at Inspire's casino were to blame for the deficit.

The operator from Uncasville, Connecticut, who was unable to pay off $275 million in outstanding debt, suggested covenant adjustments that were in line with market standards.

However, principal lender Bain Capital would remain unmoved. The investment group based in Boston demanded immediate payment from Mohegan or risk losing ownership of Inspire, citing an acceleration clause. Bain took control of Yeongjong Island's IR on February 19.

Stakeholders were reassured by Bain that the change of command would not effectuate any disruptions to staff or visitors' operations. The resort will continue with "business as usual" according to Inspire president Chen Si, who also mentioned the facility's new "bullish" operator.

In a new beginning for Mohegan

Mohegan may "reduce leverage, improve borrowing costs and create greater strategic flexibility" now that its debt deadlines are out until 2029, according to chief financial officer Ari Glazer.

A "clear demonstration of our unwavering commitment to the success of Mohegan," said James Gessner Jr., tribal chairman.

"Extended maturity runway and financial flexibility" are now available to the operator, according to Gessner. Our alignment with investors is strengthened as we redeploy capital back into the company," the statement read.